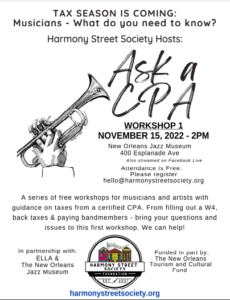

Although it’s only November, it’s time to start thinking about tax season. And for gig workers like musicians, Tax Day levies an especially difficult burden. This is why the non-profit organization Harmony Street Society was founded— to help musicians do the less glamorous part of the job. To assist, they will be hosting multiple tax workshops for musicians as part of the “Fresh Start Series: Tax Compliance.”

A CPA and tax expert will run each workshop to educate musicians on the difference between a W-2 and a 1099 year-end tax documents, tax compliance and filing back 1040s. They will also offer year-end tax tips to prepare 2022 tax returns and set up accounts with the IRS, Louisiana Department of Revenue and the Social Security Administration. Attend in person or on Facebook live. Attendance is free but registration is required by emailing [email protected].

For more information, visit Harmony Street Society’s website.

Upcoming Tax Workshops For Musicians:

Workshop 1 – Ask a CPA – November 15, 2022

Learn about W-2s and 1099s, how to fill out a W-4 and the importance of staying in compliance to receive stimulus and social security. Bring your questions and tax issues to get guidance from Harmony Street’s CPA.

Workshop 2 – Year End Tax Tips – December 16, 2022

Prepare to file your 2022 return by creating a list of your expenses and other deductions, learn about important documents to look for and ensure you have accounts with the IRS, Louisiana Department of Revenue, and the Social Security Administration.

Workshop 3 – How to Prepare Your 2022 Tax Return – January 18, 2023

Crunch time. The CPA will walk attendees through the preparation of taxes via your smartphone.

Stay up to date on the latest music news by following OffBeat Magazine on social media: Facebook Instagram Twitter